How Liability Coverage Works for Long Distance Moving

Understanding Liability Coverage for Long Distance Moves

Moving long distances presents unique challenges, especially concerning liability coverage. Understanding what protections are available can prevent unexpected losses and stress during your relocation. This article will define mover liability, compare basic options and full value protection, and examine third-party insurance policies. By gaining insights into these aspects, readers will be better equipped to select the right coverage and handle claims for lost or damaged goods. This content aims to address the common fear of not being adequately protected during a move, offering clarity and solutions to ensure peace of mind.

Key Takeaways

- Mover liability options include released value and full replacement value coverage during relocations

- Standard homeowners policies often do not cover items in transit during moving activities

- Assessing item value is crucial for selecting appropriate liability coverage for long-distance moves

- Third-party moving insurance offers enhanced protection for valuable or fragile possessions beyond mover liability

- Timely documentation and reporting are essential for successful liability claims on damaged goods

Defining Mover Liability in Long Distance Relocations

Mover liability is essential for understanding how possessions are protected during long-distance relocations. It differs significantly from separate moving insurance, which often provides broader coverage. Federal regulations dictate interstate mover liability coverage, impacting how much protection is available. Furthermore, standard homeowners policies may not cover moving cargo, highlighting the need for transparency when choosing professional movers. This section will clarify these critical aspects, ensuring individuals make informed decisions regarding their move.

What Mover Liability Means for Your Possessions

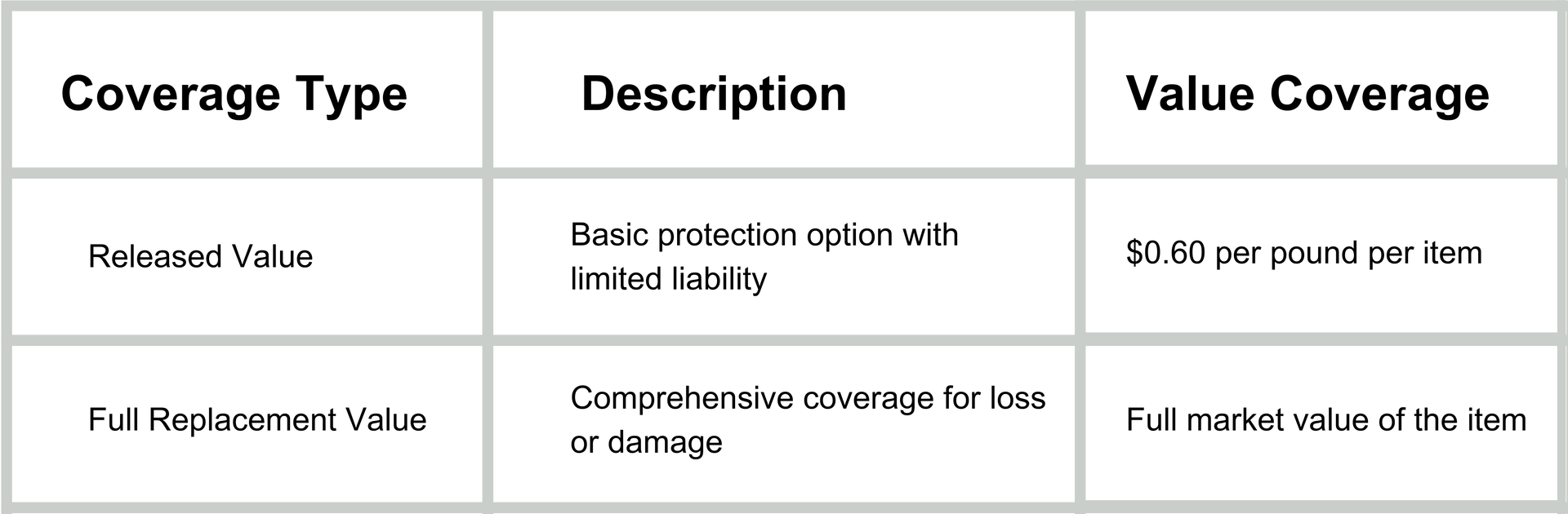

Mover liability is a crucial aspect to consider on moving day, as it directly affects how possessions are safeguarded during a long-distance relocation. When hiring a licensed long distance moving company rhode island, individuals should understand the two primary forms of liability: released value and full replacement value. Opting for full replacement value coverage often provides extensive protection for items, ensuring that valuable possessions are adequately compensated in the event of loss or damage, making it an essential moving tip for any successful relocation.

Distinguishing Liability From Separate Moving Insurance

Understanding the distinction between mover liability and separate moving insurance is critical for individuals planning a long-distance move. Mover liability, governed by federal regulations from the Federal Motor Carrier Safety Administration, offers limited protection for items during transit, typically covering only a fraction of the total value. In contrast, separate moving insurance provides a broader range of coverage options, allowing clients to customize their plans to better safeguard their belongings, especially for valuable items that demand additional protection. This insight is vital, as individuals should ensure that their moving companies are transparent about these differences to avoid unexpected gaps in coverage during their move.

Federal Mandates for Interstate Mover Liability Coverage

Federal mandates establish specific requirements for interstate mover liability coverage, ensuring the protection of customers during long-distance relocations. These regulations, set forth by the Federal Motor Carrier Safety Administration, require moving services to offer two types of liability coverage: released value and full replacement value. By understanding these options, customers can assess their risk and select appropriate liability coverage that aligns with their needs, ultimately enhancing overall customer satisfaction.

Why Standard Homeowners Policies May Not Cover Your Move

Standard homeowners policies typically do not cover possessions during long-distance relocations because they are designed to protect property within a stationary residence rather than items in transit. Long distance movers focus on logistics and transportation, which often falls outside the scope of typical homeowner coverage. This can lead to unexpected costs for moving insurance, making it essential for individuals to assess their inventory and consider separate coverage options to ensure their belongings are adequately protected throughout the moving process.

Understanding mover liability is just the beginning. Next, one must compare the basic liability options for interstate moves, uncovering the best protection for their journey.

Comparing Basic Liability Options for Interstate Moves

Released Value Protection provides minimal liability for possessions during transport, which may result in limited reimbursement if items are damaged or lost. Assessing the potential downsides of this basic coverage is essential, especially for valuable items. Certain scenarios may warrant the use of Released Value Protection, but understanding when this coverage is sufficient is crucial. This section will clarify how reimbursement works and explore practical insights regarding liability options offered by movers, including considerations for packing materials like bubble wrap and specialized services like a long distance moving company in Rhode Island.

Released Value Protection Explained

Released Value Protection is a basic form of liability coverage offered during interstate moves, providing limited reimbursement for items that may get lost or damaged. This option typically covers only $0.60 per pound per item, which means that for high-value possessions, this coverage may not suffice if a loss occurs. It is essential for individuals to weigh the potential risk of inadequate compensation against the low cost of this basic liability, especially when dealing with fragile or valuable items.

How Reimbursement Works Under Released Value Protection

Under Released Value Protection, reimbursement for lost or damaged items during a long-distance move is calculated at $0.60 per pound per item. This means that a 10-pound item would yield a maximum compensation of $6, which often fails to cover the actual value of high-end possessions. As such, individuals should carefully evaluate their belongings before opting for this basic coverage, as the financial implications of inadequate reimbursement can be significant when valuable items are involved.

Assessing the Potential Downsides of Minimal Coverage

Assessing the downsides of minimal coverage, such as Released Value Protection, reveals significant risks for individuals during long-distance moves. This basic option often results in inadequate reimbursement for high-value items, as compensation is based on weight rather than actual value. For example, a 50-pound item may only yield $30 in compensation, leaving owners vulnerable to financial loss if more valuable possessions suffer damage or loss during transit.

Scenarios Where Released Value Protection Could Be Adequate

Released Value Protection may be adequate in situations where individuals are transporting low-value or less fragile items. For example, if a family is moving basic household items like clothing or kitchenware, where replacement costs are minimal, this basic coverage could suffice. Additionally, when relocating furniture that is not considered high-end or of significant monetary value, opting for Released Value Protection can provide a cost-effective solution while still ensuring some level of liability coverage for the move:

- Transporting low-value items, such as clothes or lesser kitchenware.

- Relocating sturdy furniture that does not hold significant monetary value.

- Situations where budget constraints limit the ability to purchase comprehensive coverage.

Basic liability offers a glimpse of what protection looks like, but it might not be enough. Next, let’s look at full value protection, where true security lies for your belongings on the journey.

Examining Full Value Protection for Comprehensive Coverage

Full Value Protection offers comprehensive coverage for possessions during long-distance relocations, ensuring that items are safeguarded against loss or damage. This section will address how this coverage works, including calculating the associated costs and understanding applicable deductibles. Additionally, it will highlight mover options for repair, replacement, or cash settlement and emphasize the importance of declaring items of extraordinary value ahead of moving day.

How Full Value Protection Safeguards Your Belongings

Full Value Protection offers extensive coverage for belongings during long-distance relocations, ensuring that items are covered against loss or damage effectively. Under this plan, if an item is lost or damaged, moving companies are obligated to repair it, replace it, or provide a cash settlement for its current market value. This type of coverage is particularly beneficial for individuals with valuable or fragile possessions, as it significantly reduces the risk of financial loss during the moving process, providing peace of mind and encouraging a smoother transition to their new location.

Calculating the Expense of Full Value Protection

Calculating the expense of Full Value Protection for long-distance moves involves assessing factors such as the total weight of the items being transported and their declared value. Typically, moving companies base their pricing on the overall market value of possessions, which may require individuals to provide a detailed inventory that accurately reflects the worth of their items. This upfront evaluation not only aids in determining the cost of the coverage but also ensures adequate protection, alleviating concerns about potential financial loss during the relocation process.

Understanding Deductibles Associated With Full Value Plans

Understanding deductibles associated with Full Value Protection is essential for effective financial planning during a long-distance move. A deductible refers to the amount that a customer must pay out of pocket before the moving company is responsible for covering the remaining costs. For example, if a deductible is set at $500 and a customer's damaged item is valued at $1,000, the moving company would reimburse $500, leaving the customer to bear the initial cost. This clarity on deductibles can help individuals make informed decisions regarding their coverage options:

- Definition of deductibles in the context of Full Value Protection.

- Importance of understanding how deductibles affect reimbursement for damages.

- Examples of deductible scenarios and their financial implications.

Mover Options Repair Replace or Cash Settlement

Mover options such as repair, replacement, or cash settlement play a crucial role in the effectiveness of Full Value Protection during long-distance moves. If an item is lost or damaged, moving companies are generally required to either repair the item, replace it with a similar one, or provide a cash settlement based on the item's market value. This flexibility allows customers to choose the best resolution for their unique situation, ensuring that valuable possessions are adequately protected and that individuals feel secure in their decision to invest in comprehensive coverage.

Declaring Items of Extraordinary Value Before Moving Day

Declaring items of extraordinary value before moving day is critical for securing Full Value Protection during long-distance relocations. By providing an accurate inventory, individuals allow moving companies to properly assess and insure high-value possessions, ensuring adequate coverage. This proactive step helps minimize potential financial loss if valuable items are damaged or lost, giving individuals greater peace of mind throughout the moving process.

As one navigates the depths of full value protection, the need for additional safeguards becomes apparent. The exploration of third-party moving insurance policies reveals vital options worth considering.

Evaluating Third-Party Moving Insurance Policies

Securing third-party moving insurance becomes essential when standard mover liability fails to provide adequate coverage. This section will contrast third-party policies with mover liability options, highlighting the importance of aligning both coverage types. Additionally, it will guide readers in locating trustworthy third-party insurance carriers to ensure maximum protection of their belongings during a long-distance move.

When to Seek Insurance Beyond Standard Mover Liability

Individuals should consider securing additional insurance beyond standard mover liability when transporting high-value or fragile items. This type of coverage can provide enhanced protection against potential loss or damage that standard liability may not adequately address. For instance, if a family owns antiques or electronics valued significantly higher than their weight-based compensation, obtaining third-party insurance can mitigate financial risks and ensure peace of mind during the relocation process:

- Identifying items of high monetary or sentimental value.

- Assessing coverage limits of standard mover liability options.

- Researching reputable third-party insurance providers for comprehensive coverage.

Contrasting Third-Party Policies and Mover Liability Options

When comparing third-party moving insurance policies to standard mover liability options, it is essential to recognize the distinct differences in coverage and limitations. Mover liability typically offers minimal protection based on the weight of items, often leaving individuals underinsured for valuable belongings. In contrast, third-party insurance can provide tailored coverage that encompasses both the full market value of items and protects against a broader array of risks, ensuring that individuals are adequately safeguarded against potential financial loss during their long-distance move.

Locating Trustworthy Third-Party Moving Insurance Carriers

Locating trustworthy third-party moving insurance carriers involves thorough research and careful consideration. It is essential to look for providers with strong reputations, positive customer reviews, and transparent policy offerings. Additionally, comparing different policies can help customers find adequate coverage that suits their specific needs, particularly for high-value items that may require enhanced protection during a long-distance move.

Aligning Coverage Between Mover Liability and External Insurance

Aligning coverage between mover liability and external insurance is crucial to ensure comprehensive protection during long-distance moves. Individuals must assess the limitations of basic mover liability, which is often insufficient for high-value items, and augment it with third-party insurance that offers tailored coverage options. By taking the time to understand the nuances of both coverage types, individuals can effectively shield their belongings from potential loss or damage, providing greater peace of mind throughout the relocation process.

With the right insurance in place, moving can feel less daunting. Next, it’s time to look at how to secure the protection needed for a long-distance journey.

Steps to Secure Appropriate Protection for Your Long Distance Move

Accurately estimating the value of household goods is essential for selecting appropriate liability coverage. Individuals should obtain written confirmation of their chosen liability level, scrutinize the bill of lading for coverage specifics, and create a detailed inventory before loading begins. Engaging movers with direct questions about their liability terms ensures clarity and aligns expectations during the moving process.

Accurately Estimating Your Household Goods' Worth

Accurately estimating the worth of household goods is a critical step in selecting appropriate liability coverage for long-distance moves. Individuals should conduct a thorough inventory, assessing the market value of each item to avoid potential underinsurance during transit. Utilizing online valuation tools or consulting with moving professionals can provide a clearer picture of item worth, ensuring that the chosen coverage adequately protects valuable possessions throughout the relocation process.

Obtaining Written Confirmation of Your Selected Liability Level

Obtaining written confirmation of the selected liability level is a fundamental step in ensuring protection during a long-distance move. This documentation serves as a clear record of the agreed-upon coverage, helping individuals avoid any misunderstandings or disputes with the moving company later on. By having this confirmation, clients can confidently assess their coverage and better understand their rights and responsibilities, allowing for a smoother transition to their new home.

Scrutinizing the Bill of Lading for Coverage Specifications

Scrutinizing the bill of lading is a critical step for individuals embarking on a long-distance move, as it outlines the details of the supported liability coverage. This document serves as a legally binding contract between the moving company and the customer, specifying the type of coverage selected and any limitations involved. By meticulously reviewing this important paperwork, clients can identify their coverage specifications, ensuring their possessions are adequately protected during transit and preventing misunderstandings regarding liability in case of loss or damage:

Creating a Detailed Inventory Before Loading Begins

Creating a detailed inventory before the loading process begins is a critical step in ensuring adequate liability coverage during a long-distance move. This inventory should include descriptions of each item, their estimated values, and any special considerations, such as fragility or high value. By documenting all possessions, individuals can better assess the necessary liability protection needed and have a clear record in case of disputes regarding lost or damaged items during transit:

- List each item to be moved, including furniture, electronics, and personal belongings.

- Estimate the market value for each item to help determine the appropriate level of liability coverage.

- Note any items of extraordinary value that require additional insurance considerations.

Asking Movers Direct Questions About Their Liability Terms

When preparing for a long-distance move, individuals should prioritize asking movers direct questions about their liability terms to ensure comprehensive coverage. Inquiring about the types of liability coverage offered, such as released value and full replacement value, allows clients to understand the extent of protection for their belongings. Additionally, seeking clarification on any exclusions or specific conditions helps individuals gauge whether the coverage meets their unique needs, reducing the risk of unexpected financial loss during transit.

Even with the best preparations, losses can happen. Knowing how to handle claims for lost or damaged goods after the move is crucial for a smooth transition.

Handling Claims for Lost or Damaged Goods Post-Move

Submitting a liability claim for lost or damaged goods involves several key steps that individuals must follow. This includes adhering to specific deadlines for reporting incidents, supplying necessary documentation, and understanding the typical timeline once a claim is filed. Additionally, individuals should be aware of recourse options available if their claim is rejected or disputed, ensuring a comprehensive approach to safeguarding their interests during the moving process.

These elements are crucial for effectively navigating the claims process and maximizing recovery for losses incurred during long-distance relocations. Understanding these aspects helps individuals feel more prepared and secure in the event of any potential issues with their possessions.

The Procedure for Submitting a Liability Claim

The procedure for submitting a liability claim following a long-distance move requires careful attention to detail and adherence to specific timelines. Individuals should start by documenting any damages or losses immediately after unpacking, ensuring to take photographs and keep records of all affected items for evidence. After gathering the necessary documentation, the claimant must contact the moving company to report the issue, typically within a defined period, providing all requested information to facilitate a smooth claims process.

Adhering to Deadlines for Reporting Loss or Damage

Adhering to deadlines for reporting loss or damage is essential when filing a claim after a long-distance move. Most moving companies stipulate specific time frames for reporting any issues, often ranging from 7 to 30 days, depending on the terms of the liability coverage. Failing to report damage or loss within this period can result in claim denial, which underscores the importance of understanding and monitoring these deadlines to secure proper compensation for affected possessions.

Supplying Necessary Documentation for Your Claim

Supplying necessary documentation is a critical step when pursuing a liability claim for lost or damaged goods after a long-distance move. Customers should meticulously gather evidence, including photographs of the damaged items, the original inventory list, and any relevant receipts that demonstrate the value of the possessions. This organized approach ensures that moving companies can process claims efficiently, thereby enhancing the likelihood of receiving fair compensation for affected items.

The Typical Timeline After Filing a Claim

The timeline after filing a liability claim for lost or damaged goods during a long-distance move typically involves several key stages. After the claim is submitted, moving companies generally acknowledge receipt within a few days, followed by a thorough investigation that can take anywhere from a week to several weeks, depending on the complexity of the case. Customers should remain proactive during this period, ensuring they provide any requested documentation promptly to facilitate a swift resolution and optimize the chances of receiving fair compensation for their items.

Recourse Options if Your Claim Faces Rejection or Dispute

If a claim for lost or damaged goods is rejected or disputed, individuals have several recourse options to consider. They can first review the reasons for the denial, as understanding these factors may clarify whether further action is possible. If negotiations with the moving company do not resolve the issue, individuals may escalate the matter by filing a complaint with the Federal Motor Carrier Safety Administration or seeking assistance from a consumer protection agency, which can provide valuable guidance on navigating the claims process.

Understanding liability coverage for long-distance moves is vital for protecting personal belongings during transit. People must differentiate between mover liability and separate moving insurance to ensure adequate coverage for valuable items. By evaluating coverage options like Released Value Protection and Full Value Protection, individuals can make informed decisions that enhance overall peace of mind. Prioritizing these considerations not only safeguards possessions but also fosters a smoother moving experience.